Search for topics or resources

Enter your search below and hit enter or click the search icon.

July 1st, 2024

3 min read

Everything is expensive these days, from groceries to home upgrades. You have to pick and choose what to invest your money in. As much as you’d like to upgrade your insulation, you aren’t sure if you can afford it. If you opt for blown-in insulation in your attic, can you save money through any tax credits?

South Central Services has insulated hundreds of homes near Greencastle, Chambersburg, Waynesboro, and Hagerstown. No matter which insulation our customers choose, our goals are to provide effective insulation and to help them save money when they can. The good news is that blown-in insulation qualifies for a tax credit and can save money when you reinsulate your attic.

By the end of this article, you will understand:

Don't have time to read right now? Check out everything you need to know at a glance.

While there are plenty of tax credits and incentives at both federal and state levels, there’s currently only one federal tax credit that benefits homeowners in our service area. This credit is called the 25C Energy Efficient Home Improvement Credit, and it covers a variety of upgrades in the home.

The 25C credit isn’t just for insulation. Other home upgrades include:

If you are still budgeting for an insulation upgrade in the next few years, this federal tax credit should still be available! It became effective in 2023 and is set to continue until 2032.

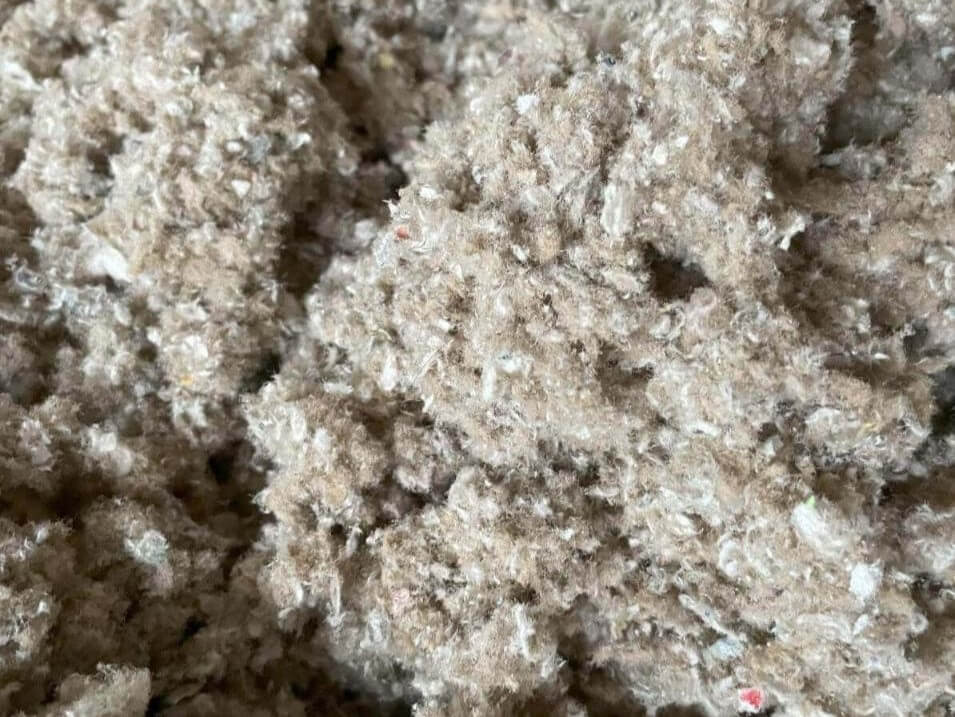

Among the energy-efficiency upgrades covered by the federal tax credit, most insulations and air-sealing products also qualify.

In addition to blown-in insulation, these insulations also qualify:

Air-sealing is also covered under the insulation section of the 25C tax credit. Blown-in insulation doesn’t include an airtight seal like spray foam insulation. However, you can air-seal your attic when you reinsulate with blown-in. Both the blown-in insulation and the air-sealing product will qualify.

The insulation tax credit under the 25C Energy Efficient Home Improvement Credit offers 30% of a project cost up to $1,200.

A total project cost of $4,000 will maximize savings on this credit. A less expensive project will not reach the $1,200 threshold, and a more expensive project will exceed the threshold with no additional savings.

The price of blown-in insulation and air-sealing depends on the size of the attic. Other factors include existing insulation removal and which blown-in insulation you choose.

Blown-in fiberglass insulation is usually less expensive than blown-in cellulose. However, their price points are constantly fluctuating.

For the average attic around Greencastle, Pennsylvania, that we insulate with blown-in Nu-Wool cellulose, the price ranges between $1.25 and $4.00 per square foot.

Once you commit to an insulation upgrade, how do you claim your tax credit?

Whether you work with a tax professional or file your taxes yourself, you’ll need Form 5696. You may also need to keep receipts of your insulation.

You can also file for this credit whether you upgrade your insulation as a DIY or hire a professional. Ask your contractor for any relevant information if you work with a professional.

If you’re on the fence about upgrading your attic insulation, consider investing in blown-in insulation with an airtight seal. While spray foam will deliver premium performance, the best budget solution is blown-in insulation paired with air-sealing.

Since using air-sealing products can be daunting, we recommend hiring a professional to complete your attic insulation. A professional contractor can deliver good results that are also insured. Blown-in is technically a DIY insulation, but it can be frustrating for homeowners to install on their own.

If you do choose blown-in insulation with an airtight seal, you could save up to $1,200 on your project through the federal insulation tax credit.

Blown-in insulation does qualify for a federal tax credit called the 25C Energy Efficient Home Improvement Credit. Like other insulation products, you can be credited 30% of the project cost, up to $1,200.

If you choose blown-in insulation for your attic, we recommend also upgrading to an airtight seal. Blown-in cellulose and fiberglass cannot air-seal on their own, but air-sealing products are also covered under 25C.

Now that you understand how much you can save on blown-in through the federal tax credit, your next step is to:

Disclaimer: While we strive to publish information accurate to building science, local building codes and standards supersede our recommendations.

Alexis has been fascinated by spray foam insulation since 2018. When she isn’t thinking about insulation, Alexis is geeking out over storytelling and spreadsheets.

Topics: